Equipment Leasing & Finance Foundation Releases December Report

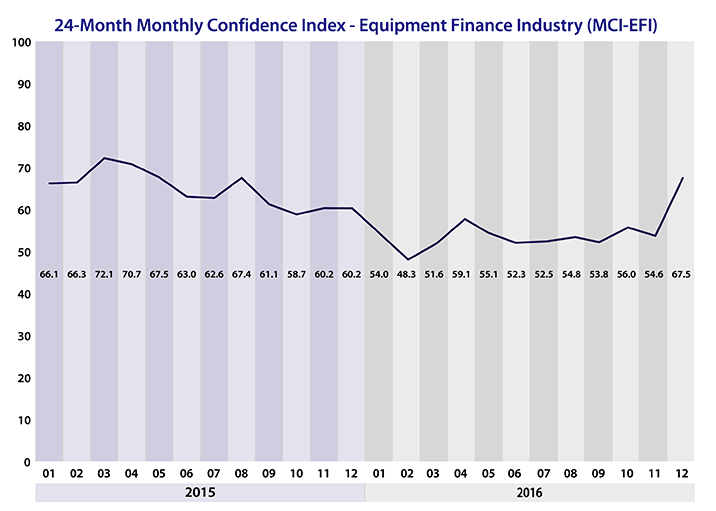

The Equipment Leasing & Finance Foundation has released the December 2016 Monthly Confidence Index for the Equipment Finance Industry.

Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $1 trillion equipment finance sector. Overall, confidence in the equipment finance market is 67.5, a sharp increase from the November index of 54.6, with equipment finance executives expressing post-election optimism.

When asked about the outlook for the future, MCI-EFI survey respondent David Normandin, managing director, commercial finance group, Hanmi Bank, said: “I am optimistic as the election cycle is finally behind us, and regardless of the side, people will begin to accept it and move forward. I also think an interest rate increase will be healthy, and I believe that we will see that happen this coming year.”

December 2016 Survey Results:

- When asked to assess their business conditions over the next four months, 48.4% of executives responding said they believe business conditions will improve over the next four months, an increase from 13.8% in November. 45.2% of respondents believe business conditions will remain the same over the next four months, a decrease from 69.0% in November. 6.5% believe business conditions will worsen, a decrease from 17.2% the previous month.

- 38.7% of survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase over the next four months, an increase from 13.8% in November. 54.8% believe demand will “remain the same” during the same four-month time period, down from 69.0% the previous month. 6.5% believe demand will decline, down from 17.2% who believed so in November.

- 22.6% of the respondents expect more access to capital to fund equipment acquisitions over the next four months, an increase from 13.8% who expected more in November. 77.4% of executives indicate they expect the “same” access to capital to fund business, a decrease from 82.8% the previous month. None expect “less” access to capital, a decrease from 3.4% last month.

- When asked, 41.9% of the executives report they expect to hire more employees over the next four months, an increase from 34.5% in November. 48.4% expect no change in headcount over the next four months, a decrease from 55.2% last month. 9.7% expect to hire fewer employees, down from 10.3% in November.

- None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from last month. 100.0% of the leadership evaluate the current U.S. economy as “fair,” and none evaluate it as “poor,” both also unchanged from November.

- 71.0% of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, an increase from 17.2% in November. 25.8% of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months, a decrease from 65.5% the previous month. 3.2% believe economic conditions in the U.S. will worsen over the next six months, a decrease from 17.2% who believed so last month.

- In December, 48.4% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 37.9% in November. 51.6% believe there will be “no change” in business development spending, a decrease from 58.6% the previous month. None believe there will be a decrease in spending, a decrease from 3.4% who believed so last month.